This ensures that unbiased contractors report their earnings accurately when filing taxes. Kind 1099 is crucial for your corporation, especially if you work with self-employed individuals or independent contractors. This form is used to report numerous forms of earnings beyond wages, salaries, and tips paid to common staff. These forms inform each the IRS and the recipient of the earnings received, ensuring that every one earnings are precisely reported for tax functions. Particulars about submitting Form 1099-NEC, the reportable fee threshold amount 1099 misc self employment, and for details about required digital submitting, are available in the Directions for Forms 1099-MISC and 1099-NEC PDF (PDF).

Penalties For Payers

1099Online handles the heavy lifting with built-in error checks, direct IRS e-filing, safe contractor supply, and reside help when deadlines shut in. In 1099Online, the correction course of is streamlined — you can generate and file the corrected return electronically, and the system routes copies to the IRS, states, and recipients. Rare exceptions, like natural disasters, may qualify for reasonable-cause penalty reduction, however prevention is all the time higher.

In Distinction To deductions, which lower taxable income, credits directly reduce the tax owed. For self-employed people, the Earned Earnings Tax Credit Score (EITC) may be out there if their earnings falls within specific thresholds. In 2024, the utmost credit for a taxpayer with three or more qualifying kids is $7,000, with eligibility primarily based on income and filing status. In TurboTax, you should be capable of find the override option if you’re within the part where it shows your 1099-MISC. Look for something like “Evaluate” or “Edit” subsequent to the shape, then there should be an option to change how the earnings is categorized. The investment platform clearly categorized it as miscellaneous earnings quite than compensation for providers, which supports your place that these have been just occasional referral bonuses and not a enterprise activity.

Why Appropriate Classification Matters

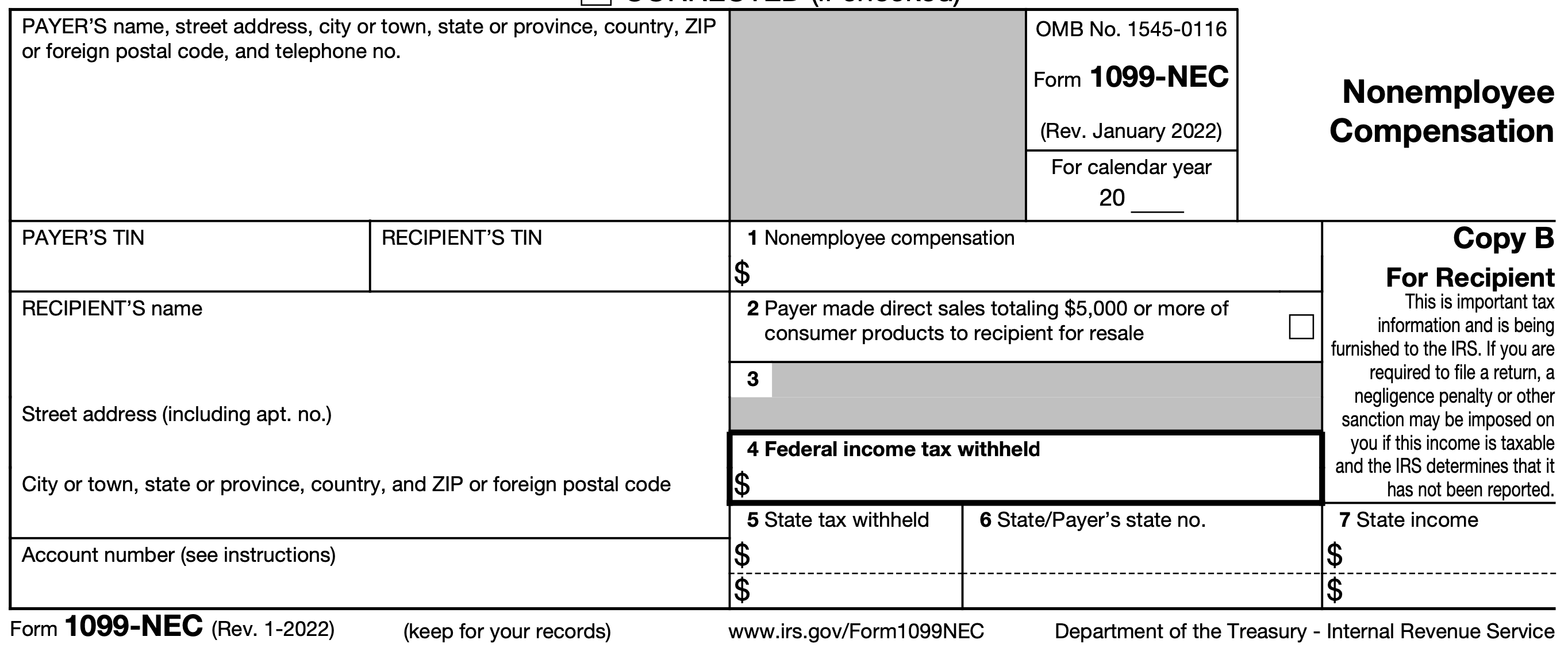

That means yearly, round tax time, you’re more probably to get one or more varieties detailing your earnings. These could arrive by mail or electronically, relying on the payer. Effectively managing 1099 filing duties is vital for businesses working with self-employed individuals. Types just like the https://www.kelleysbookkeeping.com/ 1099-NEC and 1099-MISC report revenue earned from freelancing, independent contracting, or different miscellaneous sources. Non-employee revenue, reported on a 1099-MISC, usually arises from freelance or impartial contracting work, the place the payer has less control over how tasks are accomplished.

Frequent Mistakes & How To Avoid Them

You also can jump-start your taxes by snapping a photograph of your Form 1099-NEC and your Form 1099-K, and the data will precisely switch to your tax return. If you have made the willpower that the person you are paying is an independent contractor, the first step is to have the contractor complete Kind W-9, Request for Taxpayer Identification Number and Certification. This form can be utilized to request the correct name and taxpayer identification quantity, or TIN, of the payee.

How To Classify Employees Appropriately: Employee Or Self-employed?

- Prior to tax yr 2020, self-employed individuals acquired a 1099-MISC as an alternative of a Kind 1099-NEC.

- Seems like you’d be creating a much bigger concern just to avoid wasting a small quantity on SE tax.

- I’m positively not working a referral enterprise, these were just one-time bonuses for getting a few friends to hitch the platform.

- Here Is the way to enter a 1099-MISC that you might have obtained for an additional cause.

Simply wished to update that I tried taxr.ai after seeing the advice here. My state of affairs with Coinbase referrals was truly more complicated than I thought as a end result of I had each referral bonuses and a few crypto rewards. Super helpful and saved me from overpaying about $200 in self-employment taxes. Definitely suggest for anybody coping with these bizarre 1099 conditions from investment apps. TurboTax Premium will ask you should you received the person types and can accurately fill out the right tax forms based mostly in your entries.